Dec 27, 2022Therefore, you would owe the IRS a total of $4308 in capital gains tax on the sale of your business. In the same way, if you sold the same business with a profit of $500,000 and filed your taxes jointly, your capital gains tax would be calculated as follows: ($500,000 – $52,500) x 9.3% = $44,385. In this case, you would owe the IRS a total of

CA Sales and Use Tax Guidance for Not-for-Profits

Usually, people only have to pay around 50% on their capital gains. There are other strategies, though; we will explain these shortly. Farms, fishing businesses, and small business corporation shares can qualify for a significant deduction on capital gains tax.

Source Image: cnbc.com

Download Image

California Department of Tax and Fee Administration. Whenever you buy, sell, or discontinue a business, you need to contact the California Department of Tax and Fee Administration. Review the following for more information: Permits & Licenses: Refer to “Buying, Selling, or Discontinuing a Business.”. Obtaining a Seller’s Permit: Refer to

Source Image: godaddy.com

Download Image

Guide to Federal Tax Classifications for Business Owners (2023) – Shopify The IRS states that the seller must receive between 50 to 100% of the buyer’s stock in order for it to be tax-free. As for asset transfers, you can make these tax-free as well if you receive 100% of the buyer’s stock. The only time you will be taxed is if the buyer gave you actual cash for your stock or assets.

Source Image: pinterest.com

Download Image

Taxes On Selling A Business In California

The IRS states that the seller must receive between 50 to 100% of the buyer’s stock in order for it to be tax-free. As for asset transfers, you can make these tax-free as well if you receive 100% of the buyer’s stock. The only time you will be taxed is if the buyer gave you actual cash for your stock or assets. preparation. negotiation. due diligence, and. documentation. This article presents an overview of some of the factors to consider in each of the four stages of selling a business in California. For a more general overview, read our article on the eight steps to selling a business.

Tax on Selling Stocks | Intraday trading, Stock market, Capital gain

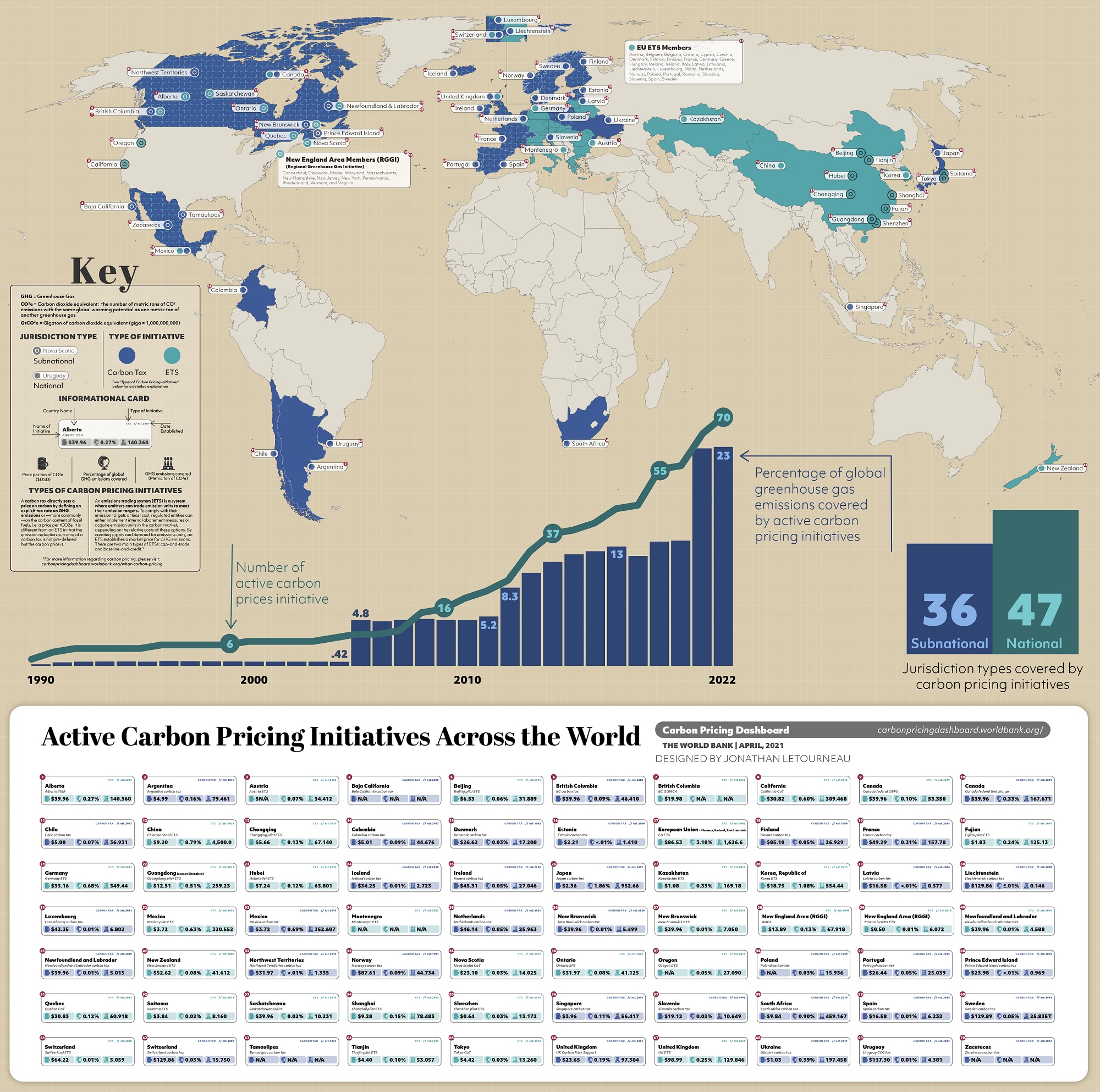

Mar 11, 2022There are two types of taxes that you will need to pay: capital gains tax and ordinary income tax. Capital gains tax is the tax on the difference between the selling price and your basis in the business. Your basis is what you paid for the business plus any improvements that you made to it. Ordinary income tax is the tax on your regular income. Mapped: Carbon Pricing Initiatives Around the World

Source Image: visualcapitalist.com

Download Image

Ecommerce Sales Tax: State Breakdown + Requirements Mar 11, 2022There are two types of taxes that you will need to pay: capital gains tax and ordinary income tax. Capital gains tax is the tax on the difference between the selling price and your basis in the business. Your basis is what you paid for the business plus any improvements that you made to it. Ordinary income tax is the tax on your regular income.

Source Image: bigcommerce.com

Download Image

CA Sales and Use Tax Guidance for Not-for-Profits Dec 27, 2022Therefore, you would owe the IRS a total of $4308 in capital gains tax on the sale of your business. In the same way, if you sold the same business with a profit of $500,000 and filed your taxes jointly, your capital gains tax would be calculated as follows: ($500,000 – $52,500) x 9.3% = $44,385. In this case, you would owe the IRS a total of

Source Image: mossadams.com

Download Image

Guide to Federal Tax Classifications for Business Owners (2023) – Shopify California Department of Tax and Fee Administration. Whenever you buy, sell, or discontinue a business, you need to contact the California Department of Tax and Fee Administration. Review the following for more information: Permits & Licenses: Refer to “Buying, Selling, or Discontinuing a Business.”. Obtaining a Seller’s Permit: Refer to

Source Image: shopify.com

Download Image

How to Pay Fewer Taxes When Selling a Business in California May 10, 2023Sales tax is typically collected by the seller at the time of purchase and then remitted to the state government. In California, sellers are responsible for the payment of sales tax based on gross sales, again, unless those sales are exempt from sales tax. In California, sales tax ranges from 7.25% to 10.25%.

Source Image: rogersonbusinessservices.com

Download Image

Do I need a business license to sell online? – GoDaddy Blog The IRS states that the seller must receive between 50 to 100% of the buyer’s stock in order for it to be tax-free. As for asset transfers, you can make these tax-free as well if you receive 100% of the buyer’s stock. The only time you will be taxed is if the buyer gave you actual cash for your stock or assets.

Source Image: godaddy.com

Download Image

Demystifying Use Tax: A Practical Guide for Businesses – Shopify preparation. negotiation. due diligence, and. documentation. This article presents an overview of some of the factors to consider in each of the four stages of selling a business in California. For a more general overview, read our article on the eight steps to selling a business.

Source Image: shopify.com

Download Image

Ecommerce Sales Tax: State Breakdown + Requirements

Demystifying Use Tax: A Practical Guide for Businesses – Shopify Usually, people only have to pay around 50% on their capital gains. There are other strategies, though; we will explain these shortly. Farms, fishing businesses, and small business corporation shares can qualify for a significant deduction on capital gains tax.

Guide to Federal Tax Classifications for Business Owners (2023) – Shopify Do I need a business license to sell online? – GoDaddy Blog May 10, 2023Sales tax is typically collected by the seller at the time of purchase and then remitted to the state government. In California, sellers are responsible for the payment of sales tax based on gross sales, again, unless those sales are exempt from sales tax. In California, sales tax ranges from 7.25% to 10.25%.