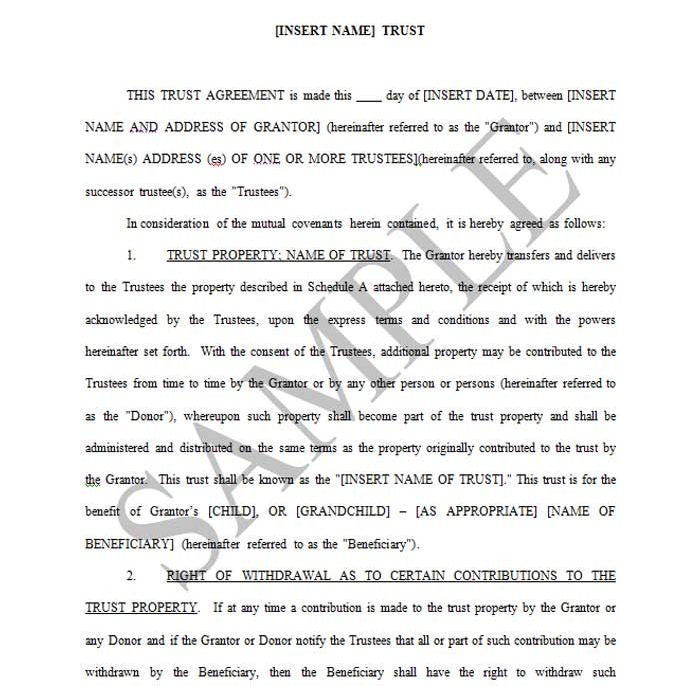

Under California law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Specifically, these trust notification requirements can come into play when: Someone passes away and, upon death, a new trust is formed by the terms of a will. A revocable living trust becomes an

California Trustee Notification Pursuant To Probate Code Section 16061.7 | PDF | Trust Law | Probate

A “§16061.7 Notice” (also called a “Notification by Trustee”). Under California law, a Trustee might be required to send this Notification to certain Trust beneficiaries and other interested parties upon the occurence of an event (for example, when a Trust becomes irrevocable upon the Settlor’s death, or a change of Trustee occurs, etc.).

Source Image: dochub.com

Download Image

Notifying Beneficiaries of Trust Administration. When a Settlor passes away, California Probate Code Section 16061.7 requires the trustee to notify the trust beneficiaries PLUS all the legal heirs (including disinherited ones) of the death. If you are working with a trust attorney, they will draft these letters on your behalf.

Source Image: saclaw.org

Download Image

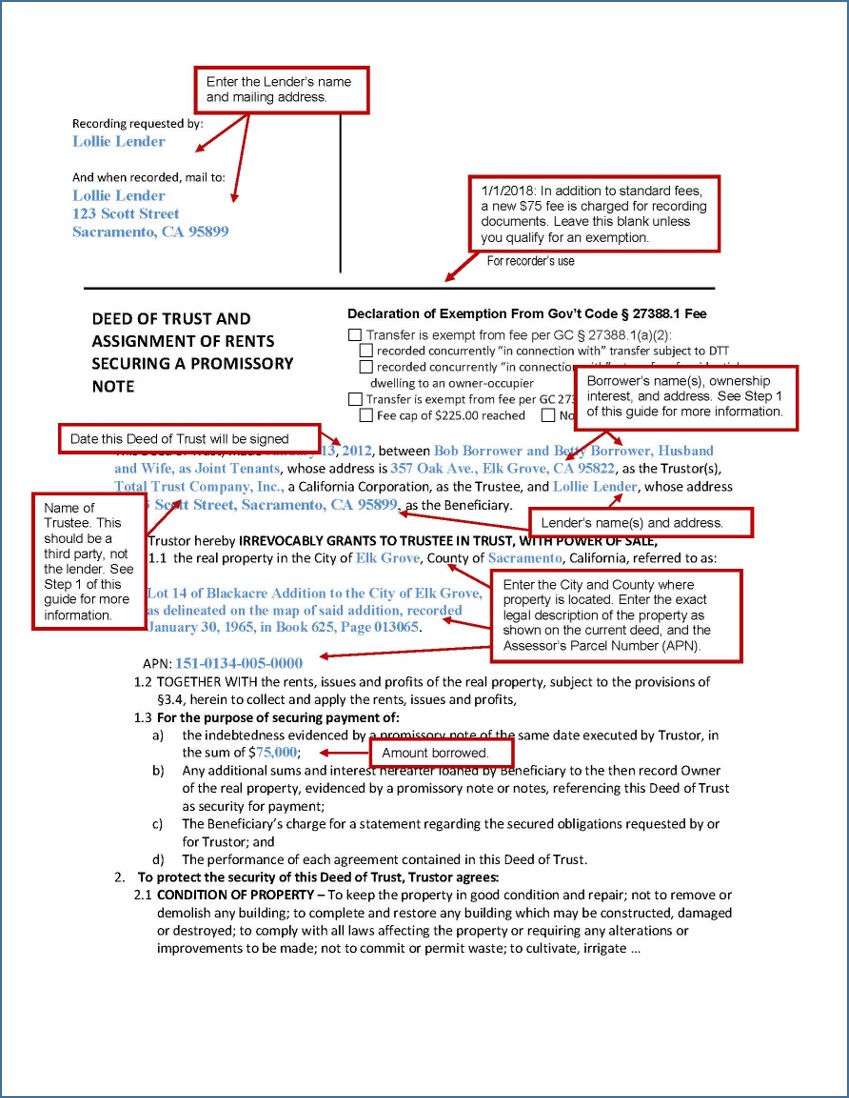

Free Certificate of Trust Form | Sample & PDF | LawDistrict Cal Prob Code § 16061.7. Trustee’s duty to serve notification of changes; Contents; Damages. A trustee shall serve a notification by the trustee as described in this section in the following events: When a revocable trust or any portion thereof becomes irrevocable because of the death of one or more of the settlors of the trust, or because, by

Source Image: signnow.com

Download Image

Sample Notification Letter To Trust Beneficiaries California

Cal Prob Code § 16061.7. Trustee’s duty to serve notification of changes; Contents; Damages. A trustee shall serve a notification by the trustee as described in this section in the following events: When a revocable trust or any portion thereof becomes irrevocable because of the death of one or more of the settlors of the trust, or because, by For example, notifications are required by the trustee: When all or a portion of a revocable trust becomes irrevocable; When there is a change of in the person or persons serving as trustee; When a settlor’s power of appointment lapses or become effective; and. When any other significant changes regarding the trust and its terms occur.

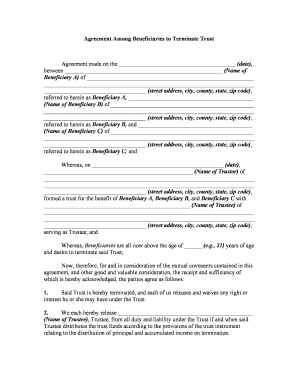

Termination of Trust Form: Complete with ease | signNow

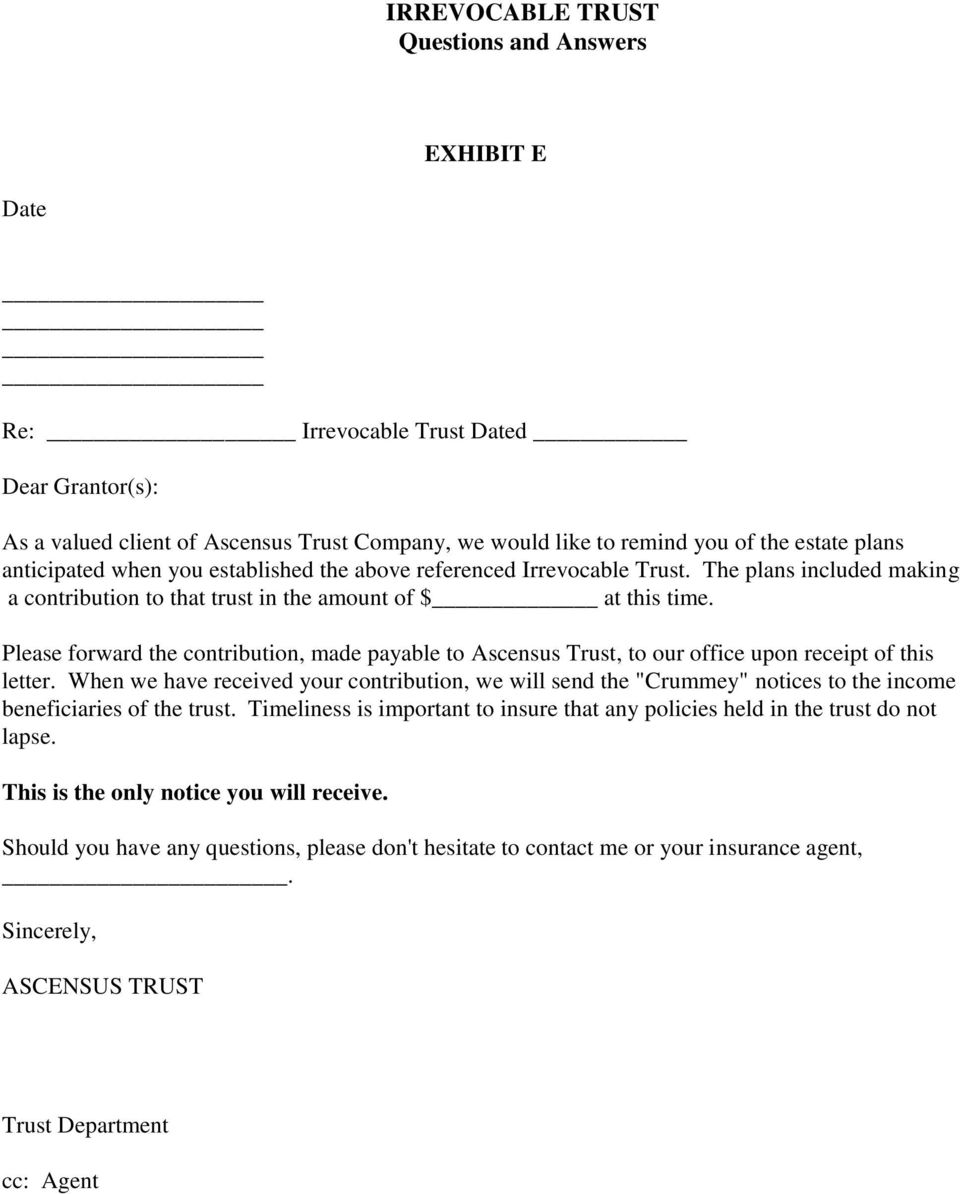

This notice must be served within 60 days of the event giving rise to the duty to provide notice. That means if a trust becomes irrevocable due to the death of the trustor, the trustee then has 60 days from the date of death to serve notice to the heirs and beneficiaries. Additionally, there are some requirements for the content of the notice Sample Accounting Demand Letter | PDF | Trust Law | Trustee

Source Image: scribd.com

Download Image

Minor’s Trust With Crummey Powers This notice must be served within 60 days of the event giving rise to the duty to provide notice. That means if a trust becomes irrevocable due to the death of the trustor, the trustee then has 60 days from the date of death to serve notice to the heirs and beneficiaries. Additionally, there are some requirements for the content of the notice

Source Image: nlfforms.com

Download Image

California Trustee Notification Pursuant To Probate Code Section 16061.7 | PDF | Trust Law | Probate Under California law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Specifically, these trust notification requirements can come into play when: Someone passes away and, upon death, a new trust is formed by the terms of a will. A revocable living trust becomes an

Source Image: pt.scribd.com

Download Image

Free Certificate of Trust Form | Sample & PDF | LawDistrict Notifying Beneficiaries of Trust Administration. When a Settlor passes away, California Probate Code Section 16061.7 requires the trustee to notify the trust beneficiaries PLUS all the legal heirs (including disinherited ones) of the death. If you are working with a trust attorney, they will draft these letters on your behalf.

Source Image: lawdistrict.com

Download Image

Sample Letter To Beneficiary With Distribution – Fill and Sign Printable Template Online Sending Beneficiaries the First Notice. When you take over as successor trustee of the trust, you need to let the beneficiaries know that you’re now in charge. Some states require specific language; in others, a simple letter in your own words will do. You will need to explain the situation, which usually includes these basic facts:

Source Image: uslegalforms.com

Download Image

IRREVOCABLE TRUST Questions and Answers – PDF Free Download Cal Prob Code § 16061.7. Trustee’s duty to serve notification of changes; Contents; Damages. A trustee shall serve a notification by the trustee as described in this section in the following events: When a revocable trust or any portion thereof becomes irrevocable because of the death of one or more of the settlors of the trust, or because, by

Source Image: docplayer.net

Download Image

Free Living Trust Amendment Template & FAQs – Rocket Lawyer For example, notifications are required by the trustee: When all or a portion of a revocable trust becomes irrevocable; When there is a change of in the person or persons serving as trustee; When a settlor’s power of appointment lapses or become effective; and. When any other significant changes regarding the trust and its terms occur.

Source Image: rocketlawyer.com

Download Image

Minor’s Trust With Crummey Powers

Free Living Trust Amendment Template & FAQs – Rocket Lawyer A “§16061.7 Notice” (also called a “Notification by Trustee”). Under California law, a Trustee might be required to send this Notification to certain Trust beneficiaries and other interested parties upon the occurence of an event (for example, when a Trust becomes irrevocable upon the Settlor’s death, or a change of Trustee occurs, etc.).

Free Certificate of Trust Form | Sample & PDF | LawDistrict IRREVOCABLE TRUST Questions and Answers – PDF Free Download Sending Beneficiaries the First Notice. When you take over as successor trustee of the trust, you need to let the beneficiaries know that you’re now in charge. Some states require specific language; in others, a simple letter in your own words will do. You will need to explain the situation, which usually includes these basic facts: